Bolt's Revenues Up 37.4% in 2023

Ridehailing giant Bolt's 2023 financials, e-bike company Cowboy's 2023 financials, Voi's presentation at VNV Capital Markets Day...

Welcome to the 12th edition of our OTD Newsletter, and extending a warm welcome to our new subscribers.

If you haven’t subscribed yet, please do subscribe!

In this newsletter:

Bolt’s 2023 Financials

Cowboy’s 2023 Financials

Voi’s Presentation at VNV Capital Markets Day

Paid Subscriber Section

Bolt’s 2023 Financials PDF (EN translation)

Cowboy’s Financials PDF (EN translation)

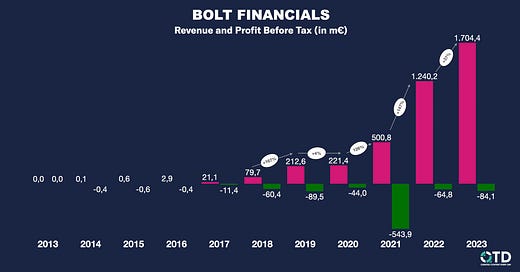

Bolt’s 2023 Financials

Recently, ridehailing giant Bolt filed their annual accounts for 2023 and here is a quick rundown

In 2023, Bolt generated €1.7B in revenue, up 37.4% from 2022, with an EBIT loss of €94.2m

Revenue Split by Business segment (vs 2022):

Driving Services: €1.39B (€995.2m)

Rental Services: €155.1m (132.3m)

Delivery: €154.8m (112.6m)

Revenue Split by Geo (vs 2022):

Europe: €1.48B (€1B)

Africa: €181.5m (€226.5m)

ROW: €39.5m (€9.1m)

Bolt has restated their revenues and losses of 2022 with €1.24B revenues vs the reported €1.26m

They spent €535.7m in marketing, similar to the previous year.

Operating expenses went up from €738m to €933.4m, a 26.4% increase compared to the 37.4% increase in revenues

At the end of 2023, Bolt had €325m in cash vs €420.7m in cash in 2022 while accumulated losses so far stand at €778m

Markus Villig is still the largest shared holder through Mordor Management OU with 16.88% ownership

For the UK and also Bolt Market (grocery delivery), Bolt is recognising revenue in the gross amount and not net (so, entire GMV and not their fee), which could inflate actual revenues when comparing to other players.

Scooters are depreciated based on rides (2k to 4k) and they expect to depreciate over one year. If they are depreciating scooters over just a year vs 3+ years as other operators, it is a smart strategy to depreciate faster, to show better EBIT results when they IPO.

They have ~€145m debt that is maturing within a year and ~€248.9m in two to five year.

Bolt owned two entities in Russia (TY Services LLC, TY Data Storage LLC). Both these entities were liquidated in 2024.

In April 2024, Bolt signed a credit line of €220m with J.P. Morgan, Goldman Sachs and others.

According to Crunchbase, Bolt has raised ~$2.3B in funds so far.

Bolt's Rental services income of €155.1m includes shared micromobility and shared cars. Without knowing the actual split, it is increasingly becoming clear that their micromobility bet wasn't the right move. I'd assume they spent €350 to €500m on it so far and I don't buy that it is to grow their ride-hailing customer base

Bolt needs to do two things before IPO:

- Stop trying hard to portray that they are not a car-centric company though >85% of revenues come from car-linked services. If Bolt really against cars, then drop/sell the core business.

- Follow the playbook of Uber and divest their shared micromobility Business. Now is the right time to offload the business to another operator (TIER-Dott, Voi, Bird etc..), take a big chunk of equity and list them exclusively on Bolt App (Similar to how Lime is exclusively listed on Uber).

If Bolt succeeds in doing the above before IPO, they could get to ~3.5x valuation at listing (may be ~€6B?). If not, I'm not sure they'll have good multiples. Curious to see how they'll navigate the business on their journey towards the expected IPO.

Cowboy’s 2023 Financials

In 2023, Belgium based e-bike startup Cowboy's revenue was down 17.6% to €33.7m from €40.9m in 2022.

Losses narrowed to €21.6m from €32.1m mostly from reduced purchases - €17.2m in 2023 vs €33.5m in 2022.

Operating losses as a percentage of revenues improved from 66.3% to 57.4%. Operating loss in 2023 was €19.3m vs €27.1m in 2022

Cowboy has booked ~€18.6m as Miscellaneous services and goods

Remuneration expenses dropped from. €7.3m to €6.2m in 2023

Cumulative losses so far stand at €103.8m. For context, according to Crunchbase, Cowboy has raised €137.5m so far.

At the end of 2023, Cowboy had negative net assets at €22.4m and about €38m in debts that are due within one year.

In H1 2023, Cowboy raised €7.8m in equity, out of which €1.4m from crowdfunding. They also raised and another €5m in venture debt from TriplePoint Capital, maturing in 30months

With the void left by VanMoof last year, sales should've been higher in 2023. having said that, decline in sales is inline with wider e-bike sales trend in Europe. In most countries, sales has declined of plateaued the last years.

Given that Cowboy is operationally not profitable (-€19.3m), they have a long way to go to be profitable. In the short term, they probably will also have to raise more funds to keep going.

In the meantime, a little known Belgian e-bike company called BizBike generated €29.3m revenue in 2022 with €72k profit before tax. A year earlier, their revenue was €30.2m with €2.42m profit before tax.

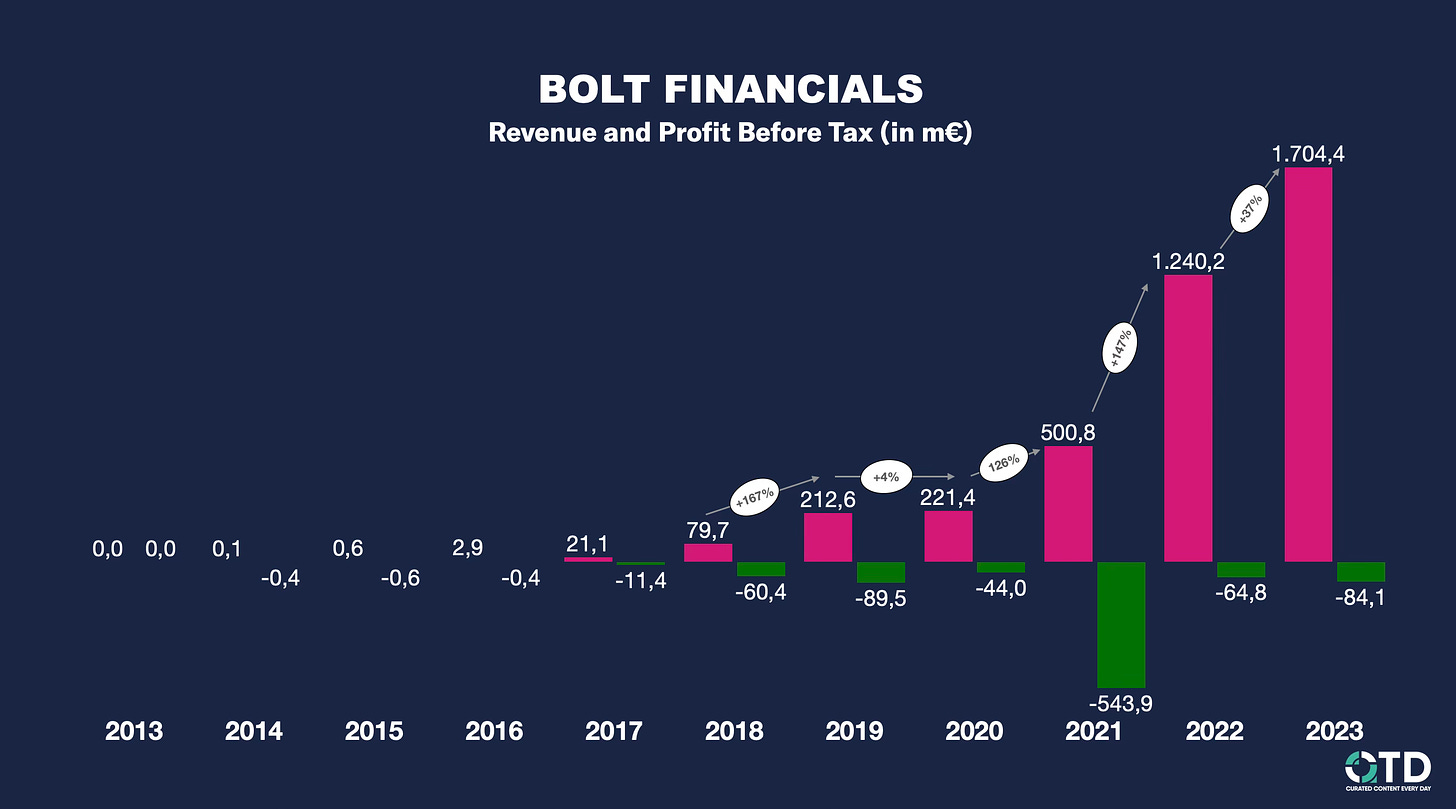

Voi’s Presentation at VNV Capital Markets Day

Voi’s CEO and CFO gave a presentation followed by a Q&A at VNV’s Capital Markets day recently. Here is a quick summary from the session

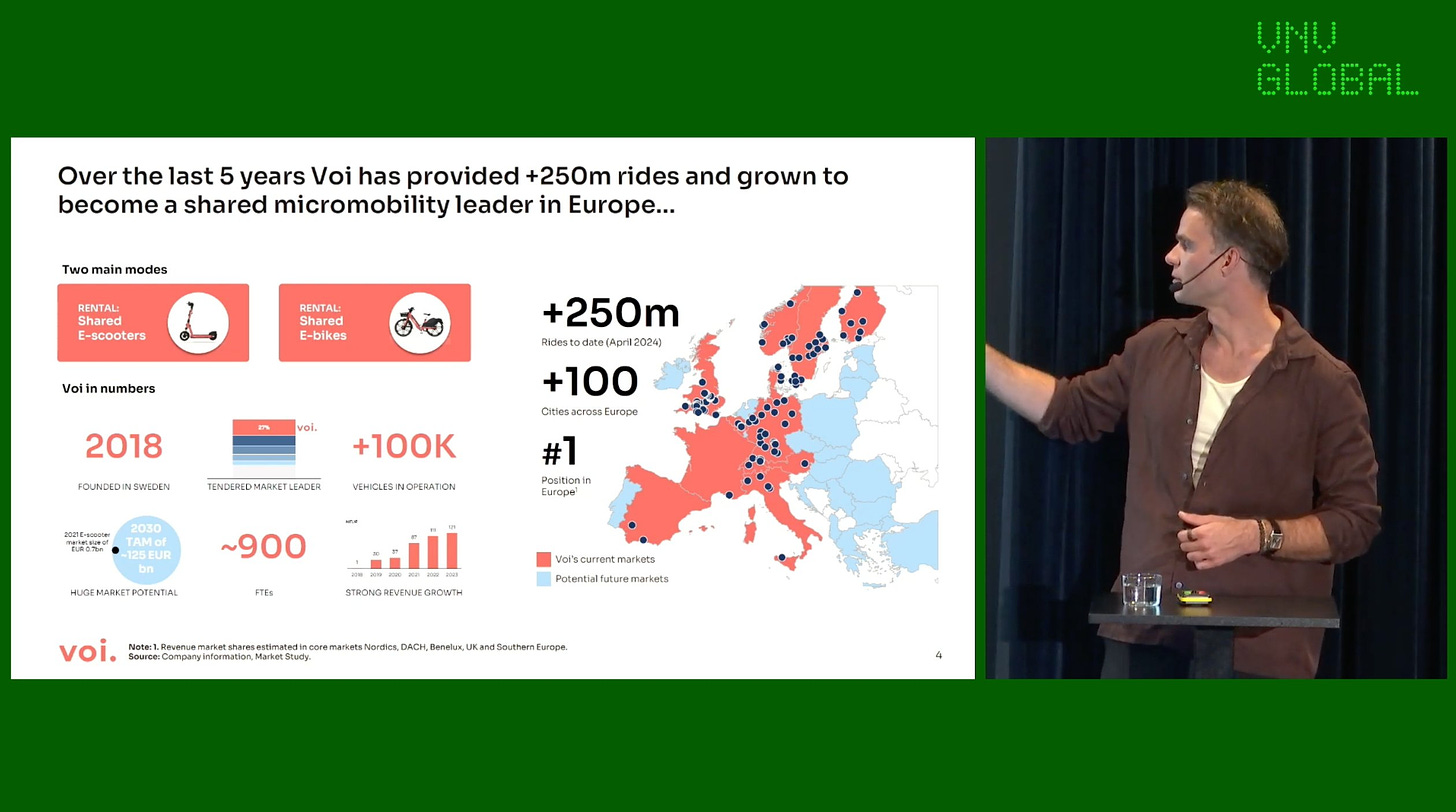

Voi reported €121m revenue in 2023 with 250m rides so far and operations in 100+ cities. And of course, they had to self-anoint themselves as the number 1 in Europe infront of their investors

Voi improved their Gross Margins to 49% but they are still losing cash with -3% EBITDA margin in 2023. They expect to be EBIT positive in 2024

Voi is spending €2.7m per month on HQ costs in 2024, down from €5m in 2022. They probably will have to cut another ~€10m+/year to keep HQ costs under 20% of their revenue.

Voi’s Founder CEO, Fredrik Hjelm said, he wouldn’t sell Voi for less than €2B and their CFO, Mathias Hermansson mentioned that Gross Margins could be upto 70% overtime with 20%+ EBIT margins.

Watch the full video here:

This concludes our newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber Section

Thank you for your support so far! If you are on founding member tier, you can reachout to have a quarterly 45min call.