95k Shared Vehicles, $35m Revenue and Profitable!

Update on Bird's Chapter 11 filing, Financials of SWING, NextBike and Beryl Bikes

Welcome to fourth edition of our OTD Newsletter, and extending a warm welcome to our new subscribers.

If you haven’t subscribed yet, please do subscribe!

In this newsletter:

95k vehicles and Profitable - SWING’s financials

What’s happening with Bird?

Beryl Bikes’ 2022 Financials

NextBike’s 2021 Financials

Paid Subscriber Section (P&L statements)

95k Vehicles and profitable - SWING’s Financials

Starting this edition with some positive news, a profitable shared micromobility company from South Korea that you probably wouldn’t have heard of!

SWING from South Korea and has about 92k shared scooters and bikes in their fleet and are profitable since 2020

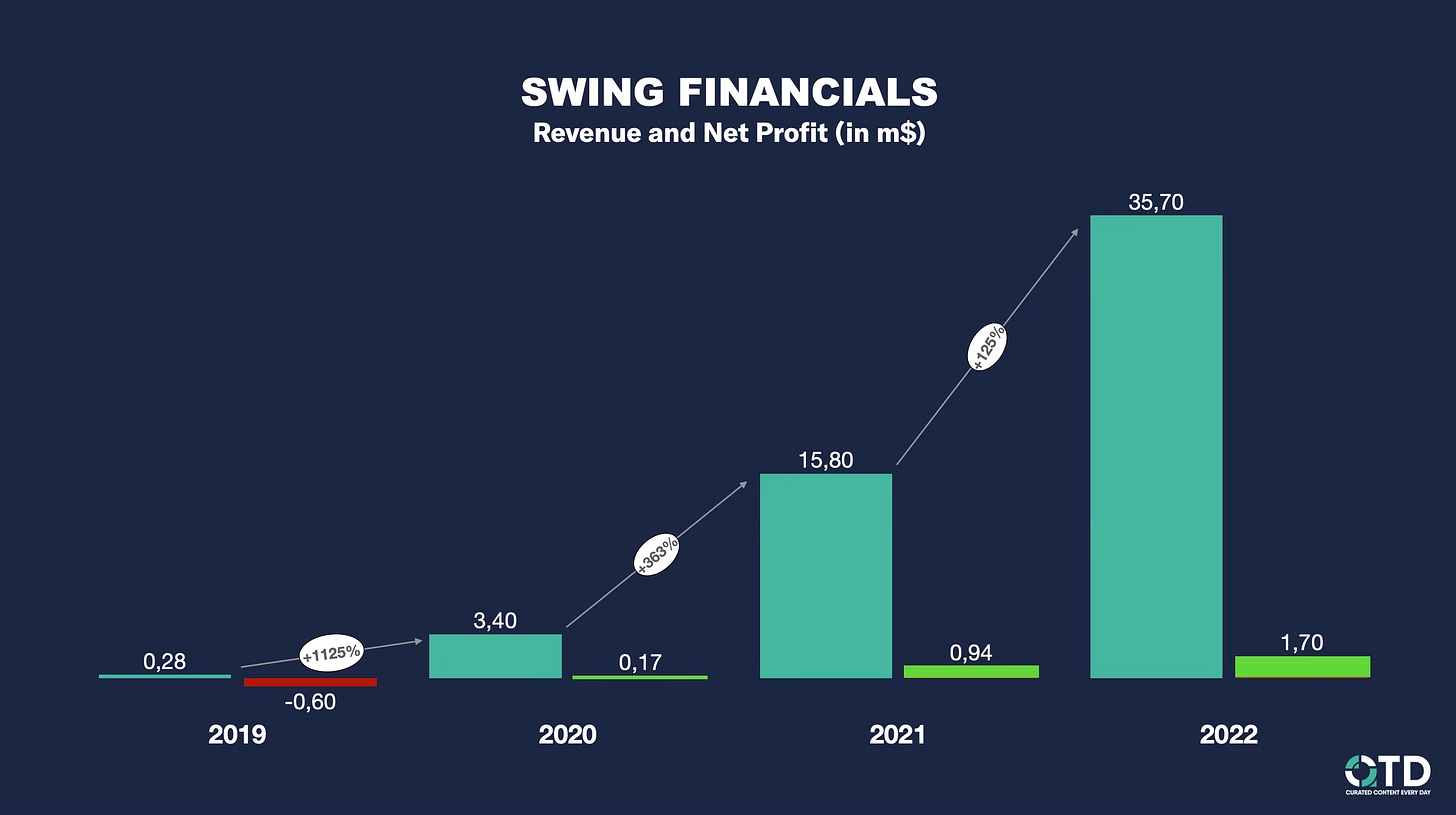

In 2022, SWING generated $35.7m in revenue, up 125% vs 2021 and posted a net profit of $1.7m.

Gross profit was $17.3m which is 49% of the revenue and SG&A was $5.7m, ~16% of the revenue

EBITDA margin was $10.5m, ~29% of their revenue and EBIT was 2%.

What are they doing differently?

Among all operators that I have looked at, SWING has one of the leanest organisations, with <20% G&A expense. For context, Bird’s G&A was 95% of their revenue in 2022.

Though franchise models did not work as expected at Bird, Swing seems to have a successful franchise model and a large portion of the fleet is now run on a franchise model - especially in tier 2/3 cities.

Also, people in South Korea take care of shared vehicles, resulting in near zero cases of vandalism or theft.

Happy to see profitable (positive EBIT) shared micromobility operators when there is a general negative sentiment around shared micromobility right now.

What’s happening with Bird?

As part of the Chapter 11 Bankruptcy filing, Bird disclosed that they generated $161.4m in revenue in 2023 (till 19th Dec 2023), much less than their 2022 full year revenue of $244.6m

Creditors with secured claims:

Midcap Financial: $41.3m principal + $2.8m interest with all assets as collateral

US Bank Trust: $63.8m principal + $7.1m interest

Tier Mobility: $2.4m

As speculated, looks like Bird did not pay the first instalment that they had to pay to Tier as part of the SPIN deal. Tier has claimed all licenses of SPIN, but Bird has contested this claim.

On the day of filing, Bird had just $3.2m in cash and $1.5m in receivables.

A new company called BIRD Scooter Acquisition Corp, incorporated in Ontario, Canada has placed a stalking horse bid to acquire all assets of Bird in the US for $79.6m (credit bid) and $500k in wind-down funding.

If the court doesn’t receive a bid higher than this before end of February, this new company setup by senior creditors would receive all assets sans liabilities.

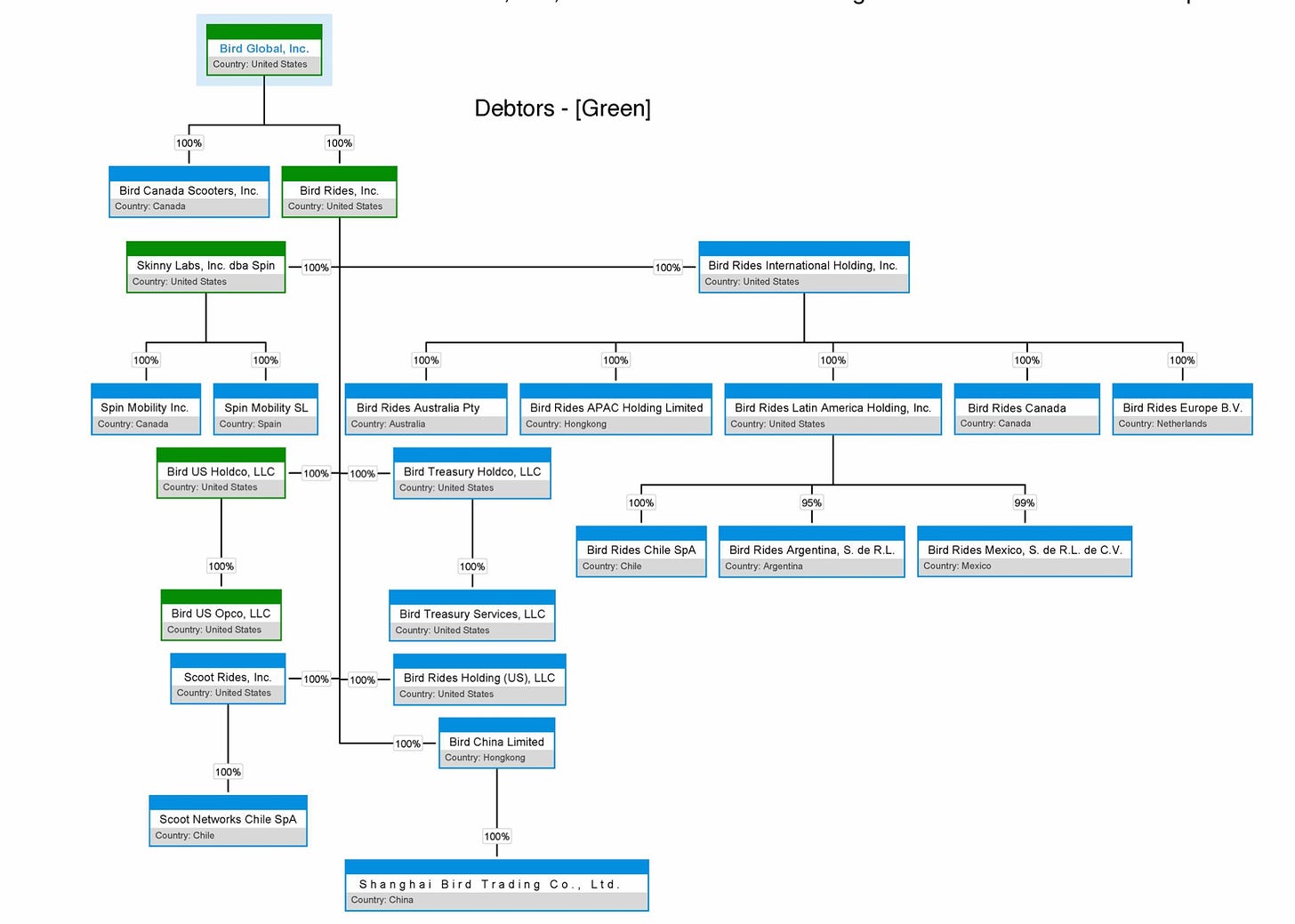

Here is how Bird is structured globally:

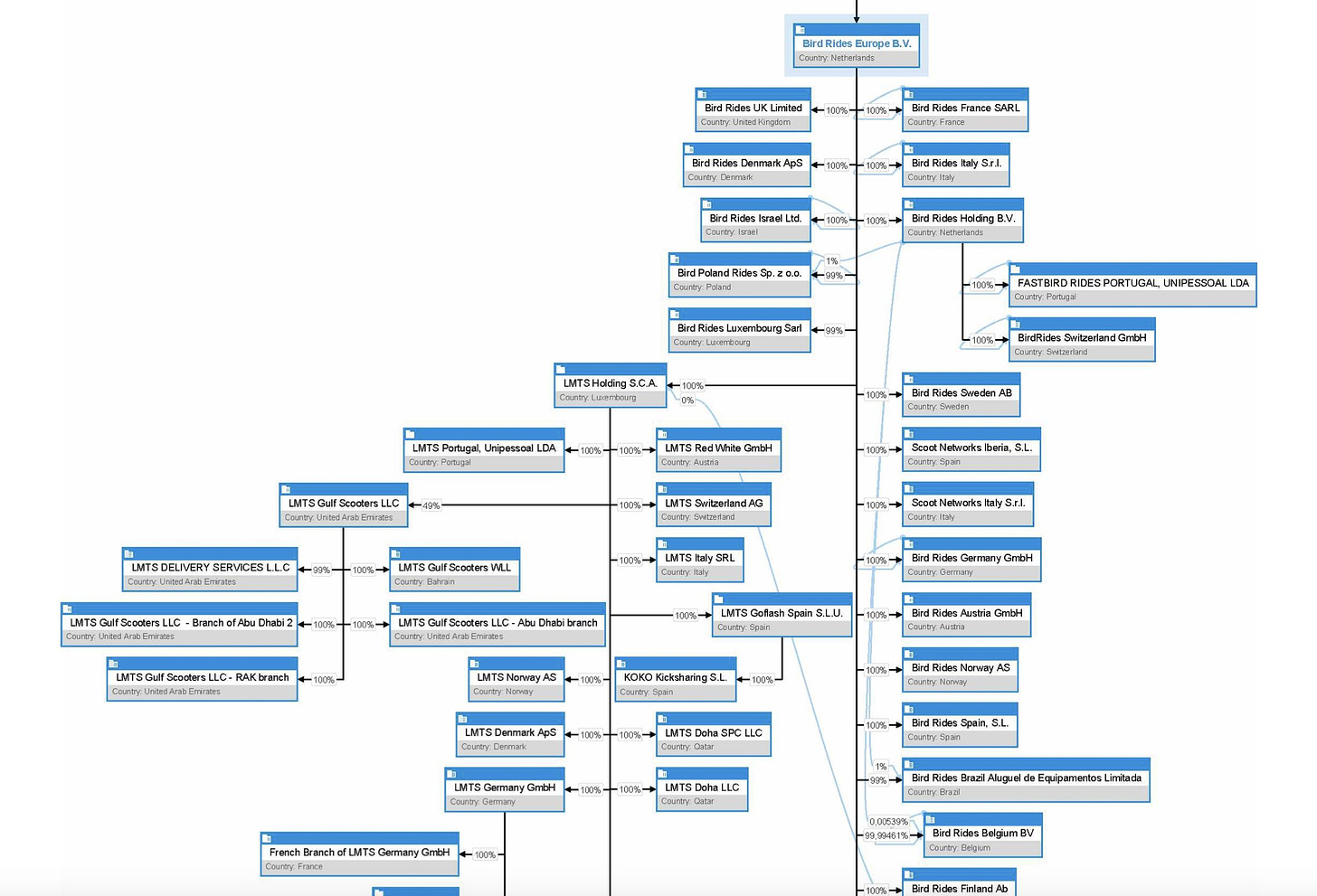

Europe Structure:

It is interesting that they are still carrying around the entire org. structure of CIRC that they acquired in 2021, though many entities are non-operational but contribute to their costs.

I sat down with James Gross from Micromobility Industries to chat about Bird’s Chapter 11 filing, general state of the shared micromobility industry and my perspectives on why I am bullish on shared micromobility, of course with some numbers! Listen here:

Beryl Bikes’ 2022 Financials

UK based Beryl Bikes generated £5.1m in revenue in 2022 and posted a loss before tax of £4.7m. Administrative expenses were ~£5m

Their Assets (£683k) are far lower than their liabilities (£5.1m)

Revenue Split:

UK: £5.1m

Europe: £18.5k

ROW: £6.6k

KPI’s

Trips: 1.2m (56% from e-vehicles)

Avg. fleet size: 2113 vehicles (31% e-vehicles)

Avg. trips/bike: 1/day

Avg. trips/ebike: 2.4/day

Avg. trips/escooter: 2.8/day

Total Active users: 176.7k

Beryl has raised £23m so far in equity and EBITDA loss in 2022 was £2.29m.

Nextbike’s 2021 Financials

In 2021, Tier mobility owned Nextbike generated €35.1m in revenue and posted a net loss of €6.5m.

In 2020, their revenue was €25.9m and net loss was €10.3m At the end of 2021, Nextbike had €1.5m in cash.

This concludes our second newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber Section

Thank you for your support so far! If you are a founding member, you can reachout to have a quarterly 45min call

In this newsletter:

Snapshot of SWING’s P&L

Nexbike’s P&L statement

Beryl Bikes’ 2022 P&L statement