Bird Files for Chapter 11 Bankruptcy Protection!

Bird's Chapter 11 Bankruptcy protectionfiling, Brompton's dividend paying bicycle business and Apple's S1.

Introducing the third edition of our OTD Newsletter, and extending a warm welcome to our new subscribers.

Did you know that Apple was profitable from the start and the growth was incredible before going public? Did we see any other company with comparable financials recently?

With that, Let’s get started!

Bird just pushed the reset button!

Bird announced earlier today that they filed for Chapter 11 Bankruptcy protection in Florida. Bird was one of the fastest to get to $1B valuation when they got started, supported by some of the top VC's in the world like Sequoia and Craft.

With the current Chapter 11 filing, lenders have set a floor value for Bird’s assets and they intend to sell assets in the next 90-120days assuming that they would receive bids above floor.

As part of this restructuring, Bird will also receive $25m loan from MidCap financial to continue operations. Note that it was MidCap that helped finance the SPIN deal as well.

Bird Canada and Europe are not part of the filing. Michael Washinushi who is the current interim CEO, will continue through and after the restructuring.

Some notable points from Bird’s Chapter 11 filing:

Bird values its current assets at >$100m

Some of the top Creditors (suppliers):

AWS: $4.8m (disputed)

Colorado Center (Lease): $3m

Zoba Inc: $1.6m

Ninebot: $1m

OKAI: $924k

Palantir: $475k

Hologram: $327k

Bird says that there is $82.6m in unused credits in 13.8m user wallets and they have asked the court to allow users to use them for rides.

Filing is made on behalf of 5 entities including SPIN:

Bird Global Inc

Bird Rides Inc

Bird US Holdco

Bird US Opco

Skinny Labs (SPIN)

With the current state, I would assume that Bird would default on payments to be made to Tier as part of the SPIN deal.

Given that they had just $10m in cash at the end of Q3, with accumulated deficit at $1.6B, this restructuring is inevitable.

Bird Stock is down ~82% today with marketcap tanking to just $1.14m. Bird was once valued at $2.5B and they have raised over $1B in equity and debt so far.

At current marketcap, Tier’s 11% holding in Bird is worth just $125k. Tier is the largest shareholder in Bird.

We’ll see tech reporters writing that this is the end of Bird but this is a Chapter 11 Bankruptcy protection filing and it is not the end. It is tough, but I really hope that Bird can sail through this.

What next for Bird?

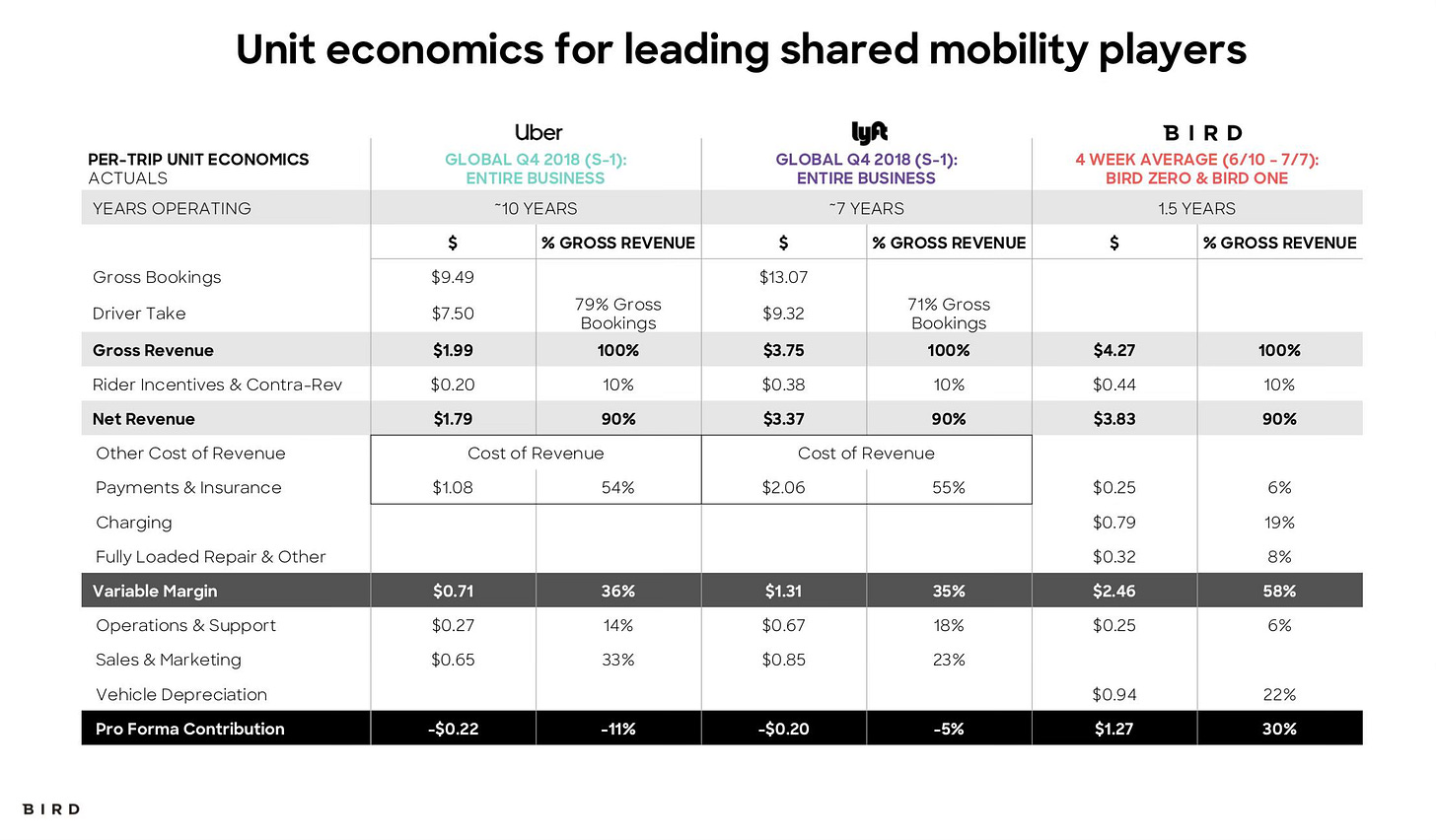

Bird’s Gross Profit margin is close to 33% in the first 9 months this year but G&A expense is 70%. Unless Bird does a complete company wide reset, re-indexing salaries and cutting costs to the bare minimum, Bird would struggle to go further than Q1 with the $25m loan.

Bird is uniquely positioned with a decent top line. With Gross profit margin improvements and G&A cut to ~20% of revenues, Bird can be a profitable company. But this won’t happen without a shakeup.

Watch my interview with Bird’s CEO where I asked him about SPIN deal, high G&A, unit economics, etc..

Follow OTD on twitter for realtime updates.

Some positive news on the ‘Owned’ side: Brompton is profitable and growing!

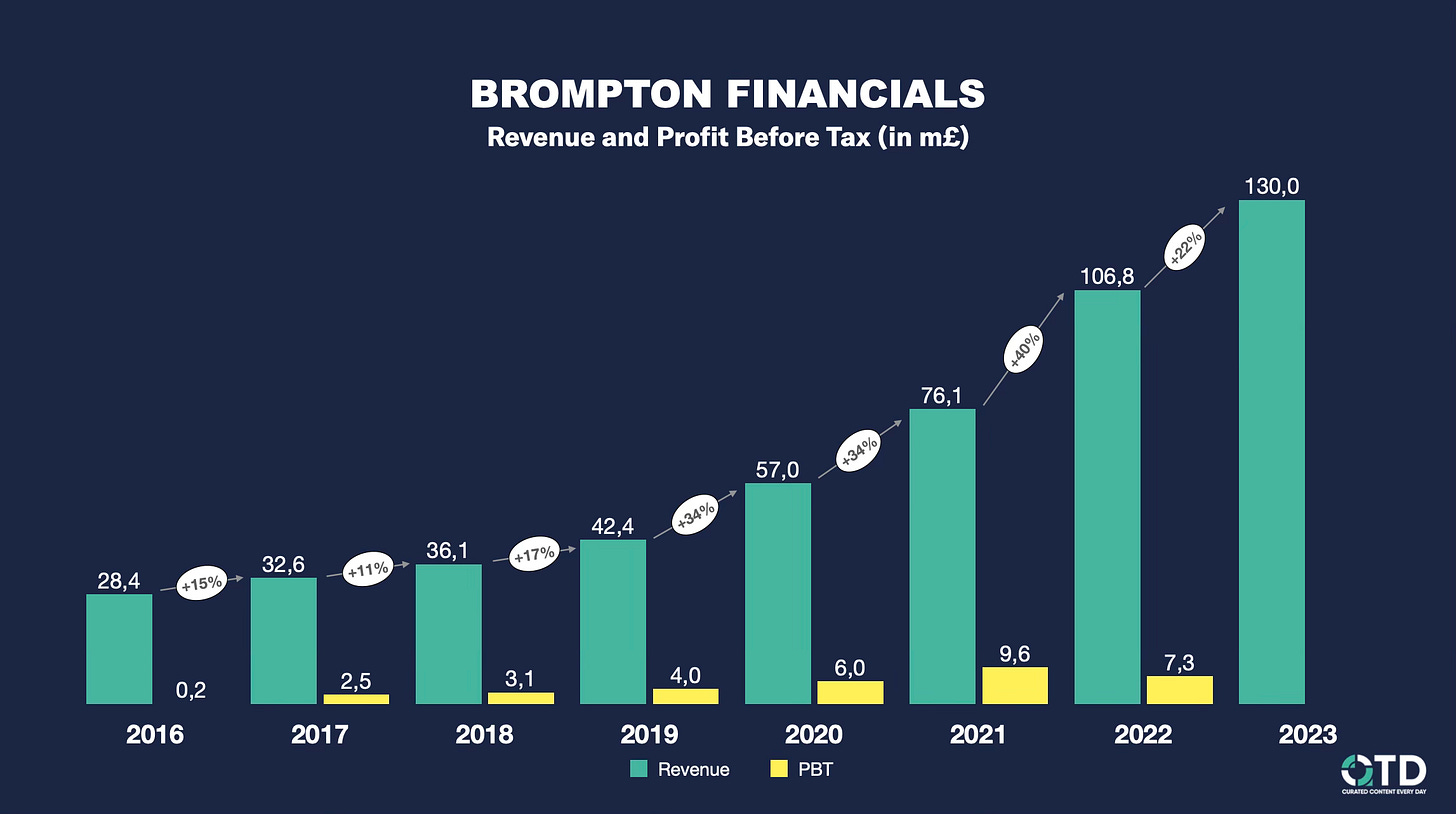

UK based Brompton bikes was profitable and paid dividends to their investors.

Brompton was founded in 1976 and they have been profitable for many years. They are popular for their light weight folding bicycles.

In Financial Year 2022 that ended in March 2022, Brompton generated £106.8m in revenue and reported a Profit Before Tax of £7.3m

Revenue was up 40.3% (£76.1m in 2021) vs previous year while profit before tax dropped 24% (£9.65m in 2021)

Revenue Split by Geography:

UK: £33m

Europe: £29.3m

ROW: £44.5m

They sold 93.4k bikes in 2022 at a Gross Margin of 47.1%. Cost of sales was £56.5m and Administrative expenses were £43m

At the end of FY2022, Brompton had £7m in cash left

Based on 2021 revenues, In 2022, Brompton paid £1.18m in dividends to their shareholders (~£12/share)

For FY2023, expected revenue is £130m (+21%)

Great to see profitable owned micromobility companies at this scale. They've remained independent, owned by the founder and few others (friends/family), but in May this year, they took in £19m external capital from BGF.

What can kill Brompton? Moving away from their most loved light weight foldable vehicles to building electric versions.

Would users pay a premium for a foldable e-bike that is heavier and comes with a battery bag that you'll have to carry around?

This concludes our second newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber section:

Thank you for your support so far! If you are a founding member, you can reachout to have a quarterly 45min call.

You can use the following links to access Brompton’s 2022 financial filing, Bird’s Chapter 11 court filings and Apple’s S1 from 1980.