Lime's Europe revenues surge 72.5% to €121.8m in 2022

Dott's 2022 Financials, Who owns Bird? Lime Europe's financials and any many more updates this week..

We're incredibly grateful for the amazing response to our inaugural OTD newsletter and extend a heartfelt thank you to all our subscribers. A special shoutout to our paid subscribers – your support is truly appreciated!

Here is our second edition. Let’s get started!

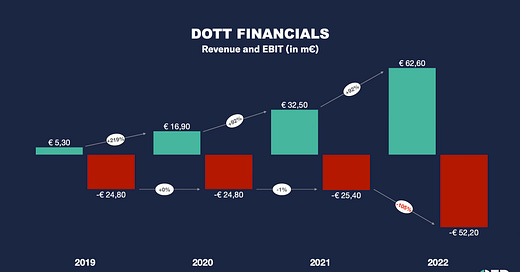

Dott almost doubles their revenue in 2022

Dott's revenue soared to €62.7m, a ~92% increase from €32.5m in 2021. EBIT loss widened to €53.9m from €25.4m in 2021.

Operating margin was €24.4m, which is 38.9% of the revenue. EBITDA loss in 2022 was €25m, up from €17m in 2021.

Geographical Revenue Breakdown

France: €27.3m (43.6%)

Belgium: €13.6m (21.7%)

Italy: €10.3m (16.4%)

The top three countries contributed over 80% of Dott’s total revenue in 2022.

28.5% of Dott's revenue came from passes, with a notable 39% in Belgium, its first market. Surprisingly, many users prefer the more expensive pay-as-you-go option.

At the year's end, Dott operated in 35 cities across 8 European countries, with a peak deployment of 50k vehicles, depreciated over 30-36 months.

Average rides per deployed vehicle per day was 2 rides per day which is higher than Bird’s ~1 ride per day.

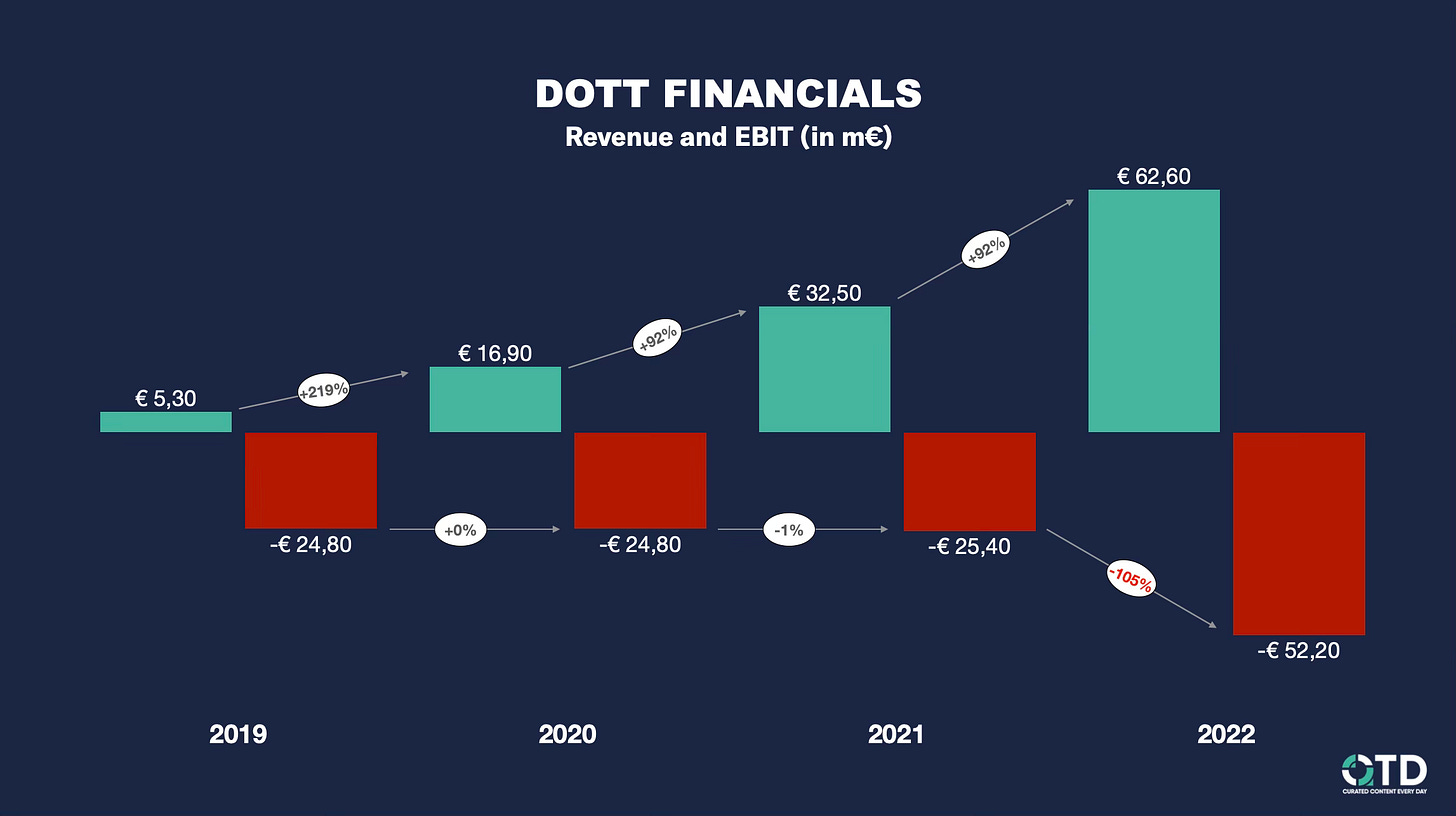

Dott had €12.7m in cash and equivalents by 2022's end, with cumulative losses reaching €132.9m. In February 2023, Dott secured €10m in debt financing, followed by a second tranche of Series C funding amounting to €7.5m in March.

Dott spent about 7% of its revenues (€4.3m) on payment fees, a figure similar to Bolt's.

Employees are the largest shareholders, with Founders holding 16.6%, Employee Stock Ownership Plan (ESOP) at 18.7%, and VCs/Angels at 64.7%.

Among institutional investors, Sofina leads with 16.5%, followed by Naspers Ventures BV at 14% and EQT Ventures at 9.6%.

An interesting observation is that Dott management’s (two founders I assume) combined remuneration (~€260k) was less than Tier CFO’s 2021 salary (~€320k)

Though Dott raised some cash this year, they’ll have to raise significant capital to keep going and also cut costs drastically.

Lime is profitable in Europe

Lime Europe’s revenue climbed to €121.8m in 2022, a significant jump from €71.6m in 2021. Additionally, they recorded €12.2m as 'Other Income', bringing the total revenue to €134m.

Administrative expenses were €131m resulting in an operating profit of €3m and Profit before tax was €2.97m.

Lime Europe owes approximately €109m to its US parent company, a debt characterized as unsecured, non-interest bearing, and payable on demand. Lime incurred a loss of around €640k due to foreign exchange fluctuations.

At the end of 2022, Lime Europe had €45.1m in cash and cash equivalents.

For asset depreciation, Lime uses a trip-count-based approach, varying by vehicle type:

e-scooters: 605 to 2070 trips

e-bikes: 463 to 1776 trips

pedal bikes: 111 trips

Lime Europe reported that their CEO, Wayne, holds a 2.5% stake in the parent company.

Lime Europe’s €134m revenue in 2022 surpassed Voi Technology's €107.9m. Notably, Lime was trailing behind in 2021 when Voi posted €90.3m in revenue.

Lime surpassed Voi with a substantial 72.5% increase in 2022, compared to Voi's 19%. However, Lime's growth pace was outstripped by Dott, which achieved an impressive ~92% growth in the same year.

While Lime Europe's success is commendable, it’s important to approach regional profitability claims cautiously. Often, costs related to HQ operations, vehicle purchases, software, etc., are not fully allocated to regional entities. This accounting flexibility can influence the appearance of regional profitability.

Bird has burnt through $1.6 Billion

Bird's revenue dropped to $54.3m, a 25% decrease from Q3 2022's $72.8m. Net loss nearly doubled to $19.8m, mainly due to an 86% increase in General & Administrative (G&A) costs.

Revenue Breakdown:

Sharing: $51.9m

Platform: $923k

Product Sales: $1.48m

Geographical Revenue Split:

Americas: $37.8m

EMEA: $16.3m

Rest of World: $123k

G&A expenses hit $31.39m, while R&D costs were at $1.4m. Compared to last year's $322.3m, the net loss improved to $73.4m.

By the end of Q3, Bird had $10.2m in cash and equivalents, plus $3.5m in restricted cash.

Key Performance Indicators (Compared to Q3 2022):

Rides: 9.68m (down 35%)

Average rides per vehicle per day: 1.33 (down 11%)

Total Cost of Sharing: $33m (down 23%)

Gross Profit: $18.8m (down 23%)

The Spin Deal with TIER Mobility:

Bird received $3.2m in cash, $32.2m in vehicles, and other assets worth $5.3m.

The deal valued SPIN at $26.1m, closing at $15.7m.

Revenue and net loss attributed to SPIN in Q3 were $2.1m and $0.4m, respectively.

Who Owns Bird?

Tier Mobility is the largest shareholder in Bird with 11.1% ownership, higher than Bird’s founder Travis (9.9%) Travis still controls 66.1% of the voting power while Tier has just 3.8% voting rights.

Bird has cautioned about the potential need to cease operations or file for bankruptcy without additional funding. The company faces three lawsuits and is under an SEC investigation related to restated revenues.

Despite reducing R&D costs, Bird's high G&A expenses (72% of revenues) raise concerns. The possibility of profitability at scale exists, but requires a shift from a VC-backed to a PE-owned culture.

Gross profit margin improvement is minimal, suggesting room for optimization to achieve around 45%. Upcoming slow months of Q4 2023 and Q1 2024 will be crucial for Bird.

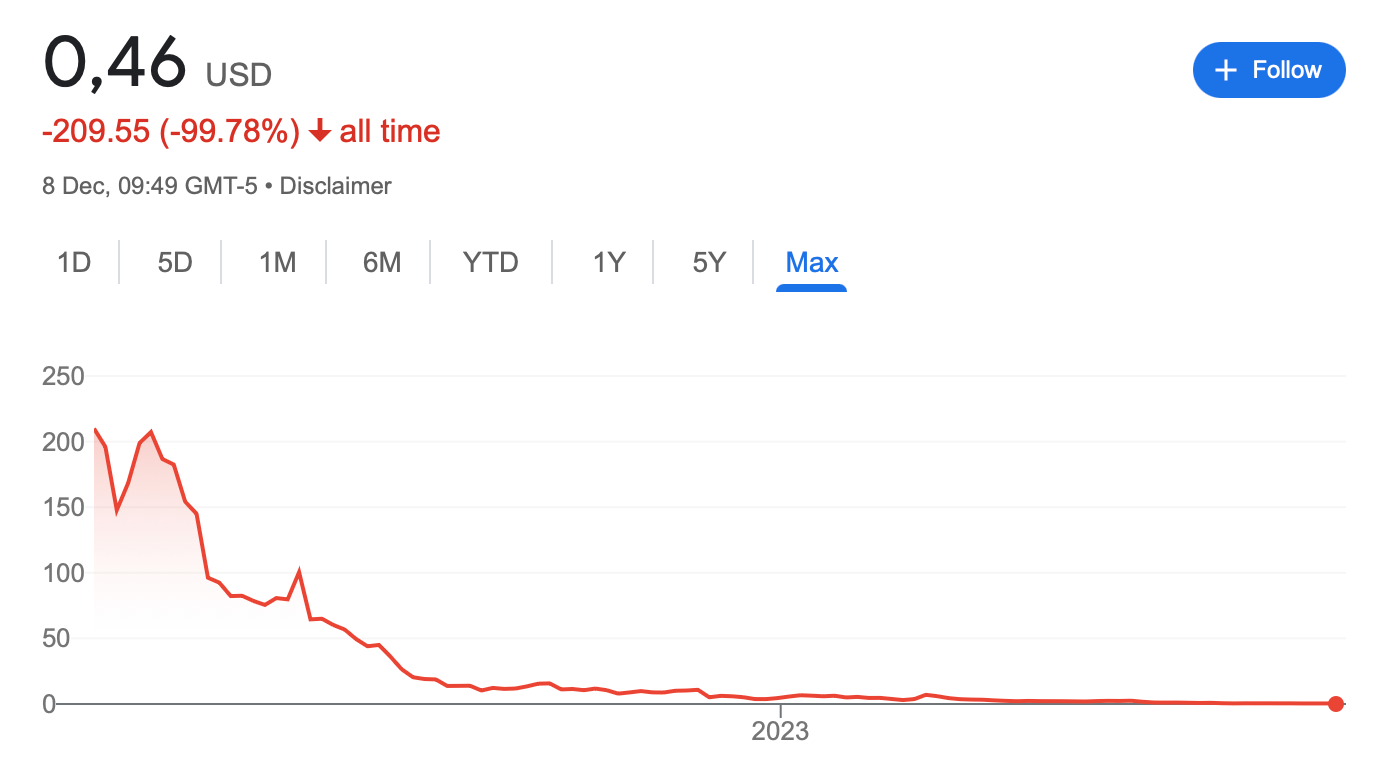

Who performed the best in EBITDA?

Norway based Ryde performed the best, with 17.5% EBITDA, followed by Lime at 3.2%. Helbiz (now called Micromobility.com Inc) performed the worst posting 422% EBITDA loss.

This concludes our second newsletter. If you would like to stay updated everyday, do follow @OTDToday on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe!

Paid Subscriber section:

You will receive an extended version of Dott’s financials with P&L statements in a paid subscriber only newsletter in the next days.

If you are a founding member, you can reachout to have a quarterly 45min call.

In addition to this, if you would like to take a peak into the entire financial filing of Lime, Dott and Bird, use the links below: