MaaS Global: End of an Era

Financial performance of MaaS Global over the years, Tier + Dott Deal, 2023 financials of getaround..

Welcome to the ninth edition of our OTD Newsletter, and extending a warm welcome to our new subscribers

If you haven’t subscribed yet, please do subscribe!

In this newsletter:

Tier + Dott

2022 Financials of MaaS Global

2023 Financials of getaround

Paid Subscriber Section

MaaS Global 2022 Annual accounts PDF (English)

getaround’s 2023 P&L and 8K filing PDF

Tier + Dott is born!

TIER Mobility and Dott has closed the merger transaction creating TIER-Dott. Both Tier and Dott apps will exist for now, with possible convergence in the future.

This is a massive big step for shared micromobility globally and also a positive signal that there is hope. If you have spent enough time looking at Shared MM financials, it is clear that Gross Margins are high, but you need scale and a lean team to be profitable.

TIER-Dott is well positioned to be EBIT positive soon and when it happens, it would be a massive milestone for shared MM.

I spoke about this deal in the recent Micromobility Industries podcast together with James Gross and Augustin Friedel. You can listen here:

MaaS Global: End of an Era

Finland based MaaS Global, recently filed for Bankruptcy after failing to find a buyer. Sifted reported that they raised $162m so far (€64.2m according to Crunchbase), from Denso, Nordic Ninja, BP Ventures and others.

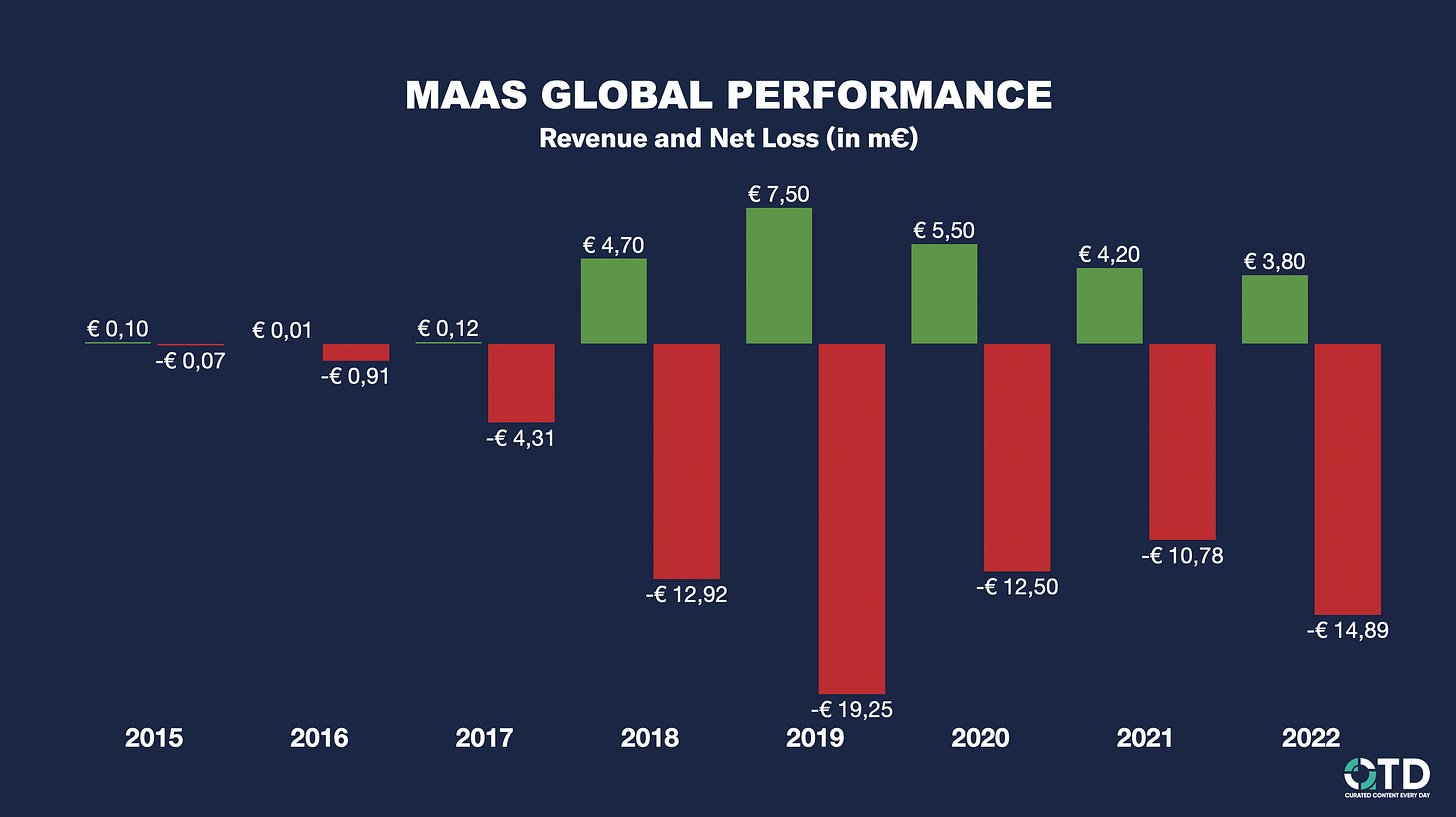

Though they saw rapid growth in 2018, their revenues were on a downtrend from 2019, with massive losses.

MaaS Global hasn’t published their 2023 numbers yet. So, following breakdown is their 2022 numbers.

In 2022, MaaS Global generated just €3.8m in revenues and posted a net loss of €14.89m

Revenue was down ~9% vs 2021 and almost half of their peak revenue (€7.5m in 2019). Net loss increased by 38% from €10.78m loss in 2021.

Cost of sales (Excl. people) was €4.1m and people costs were €7.2m. They have also booked ~€6m in ‘Other’ business expenses, resulting in an operating loss of €14.4m.

Cumulative losses till end of 2022 were ~€74.5m

In May 2023, a district court approved a debt restructuring plan that would help reduce net debt by €2.1m. In addition, a debt repayment plan for €3.4m was put in place with regular payments every year till 2030.

As part of the restructuring, MaaS Global had to liquidate all subsidiaries that did not have good results. MaaS Global sold their Japanese subsidiary to their local manager Tomo Shimada in July 2023, saving liquidation costs

In Q4 2022, MaaS Global changed their strategy from D2C to licensing their product and technology to partners, signing a first contract in Italy. They also signed a deal with a car manufacturer in May 2023, which was extended in September 2023.

To improve revenues, MaaS Global acquired Brazil based Quicko in April 2022. Six months after the acquisition, Quicko was shut down. MaaS Global also shut down Wondo, that they acquired in 2021.

In a strange move, MaaS Global gave out loans to employees at 1% interest to purchase shares as part of a Stock based incentive system between 2018 and 2021.

Interestingly, MaaS Global had 33 board meetings and 5 supervisory board meetings in 2022, which is more than three board meetings every month on average.

With the amount of cash raised so far, rapid decline in their revenues from 2021 is concerning, given that they acquired Quicko and Wondo in the meantime. MaaS is an interesting concept, but it failed to find a viable business model.

Getaround’s 2023 financials

In 2023, carsharing company getaround generated $72.6m in revenues (+22%) and posted a net loss of $113.9m.

Gross Booking Value was up 16% to $203.9m in 2023, vs $175.4m in 2022.

Revenue Split:

Service Revenue: $71.1m

US:$45m

Europe: 26m

Lease Revenue: $1.5m

US: $867k

Europe: $661k

Total trips slipped 1% to 938k trips in 2023 from 941k trips in 2022.

getaround spent ~$51m in G&A expenses and $65.4m in Operations and support. G&A was ~70% of their revenues, in a year when they should’ve been lean.

They also spent $18.5m in marketing, down 46% from $34.5m in 2021

Though net loss was $113.9m, geraound reported that their adjusted EBITDA loss was $72m, down from $89.7m loss in 2022.

~$19.3m in revenues came from HyreCar acquisition, implying that their core business revenues went down. Without Hyrecar, revenue would be $53.3m. For context, 2022 revenues were $59.4m

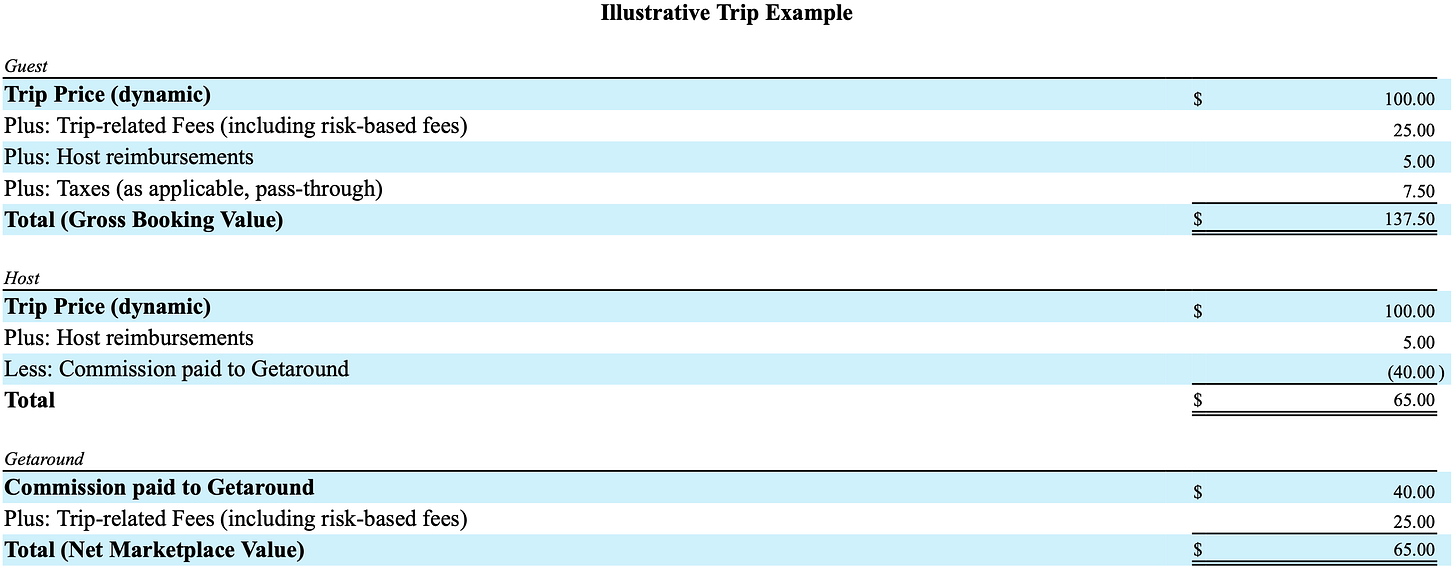

How much does getaround make from bookings? Out of $137.5 that a customer would pay as an example, getaround keeps $65 (~47..2%)

At the end of 2023, getaround had $197m in longterm debts and $23.9m in operating leases.

Cash and cash equivalents dropped to $15.6m from $64.2m in December 2022.

A month ago, Board of getaround removed their founder CEO and appointed Eduardo Iniguez as the new CEO. Here is Eduardo’s compensation package:

$350k joining Bonus

$650k Base Salary

$650k yearly Bonus

$6m Bonus at $0 EBITDA for 4 consecutive quarters

$5m Bonus at $25m EBITDA for 4 consecutive quarters

10% Stock Grant now and another 10% around 2027

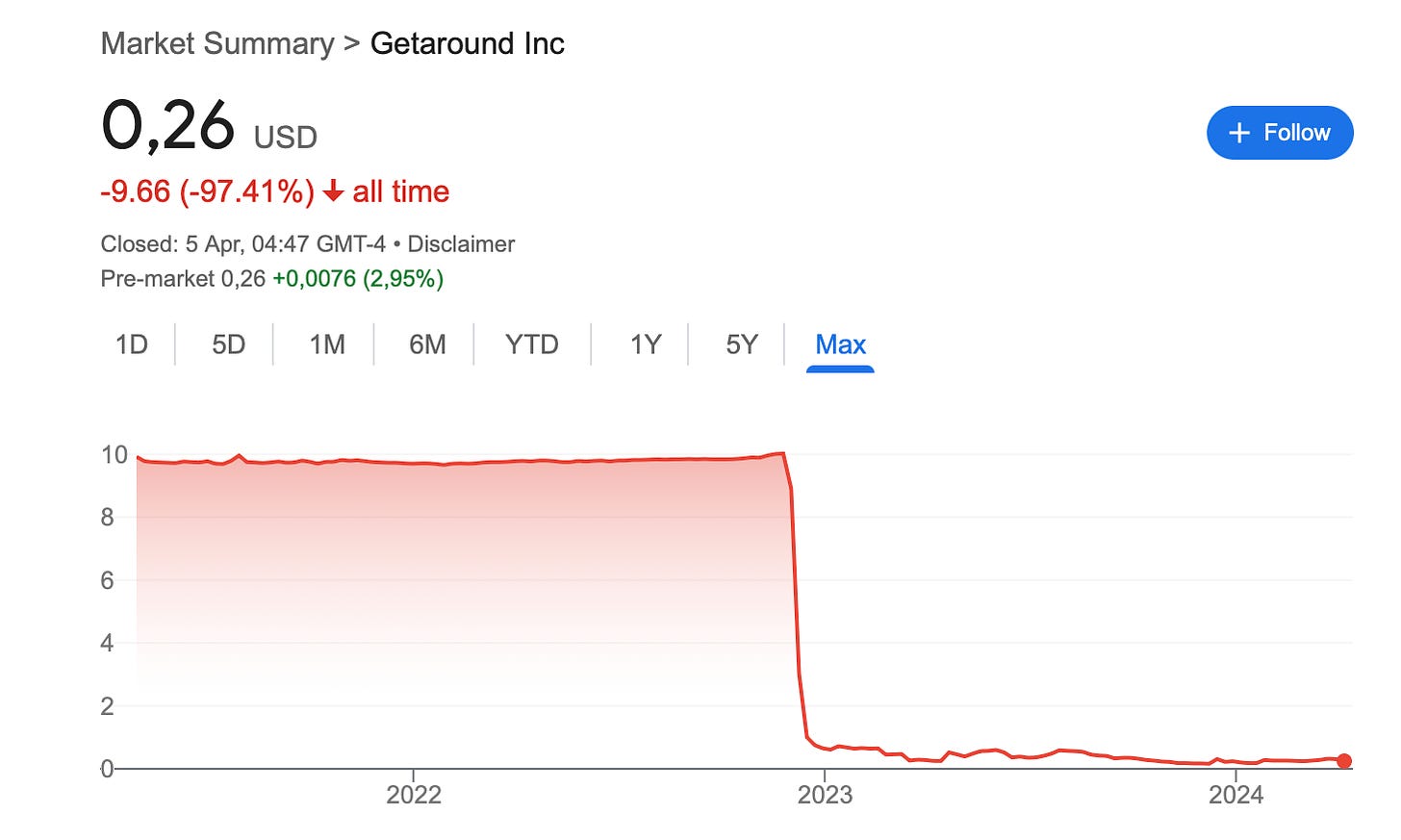

Getaround stock is down 97% and current marketcap is ~$24m. Getaround raised $763m so far according to Crunchbase.

This concludes our newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber Section

Thank you for your support so far! If you are on founding member tier, you can reachout to have a quarterly 45min call