SPIN Posted Net profit Two Months In A Row

Tier's 2021, 2022 and 2023 revenues incl. 2024 projections, Voi's new valuation, March financials of SPIN and BIRD...

Welcome to the eleventh edition of our OTD Newsletter, and extending a warm welcome to our new subscribers

If you haven’t subscribed yet, please do subscribe!

In this newsletter:

March Financials of SPIN and BIRD

VOI’s Valuation Update - Q1 2024

TIER’s 2021 financials and Merger Updates

Paid Subscriber Section

March report of SPIN and BIRD incl. full filing PDF

VNV’s Quarterly report PDF

TIER’s 2021 P&L incl. annual filing PDF in English

March Financials of SPIN and BIRD

SPIN reported two consecutive months of net profit as part of their mandatory Chapter 11 reporting. In March SPIN generated $2.08m in revenue and posted a net profit of $390.7k. Revenue was up 28.3% vs February and net profit was up ~97%.

Though SPIN posted a profit, cash at the end of March was negative $1,029 because of an intracompany cash transfer of $1.61m.

In the meantime, BIRD generated $3.68m in revenue and posted a net loss of $8.37m. G&A was more than their revenue at $8.2m. Though BIRD had $3.1m in cash at the start of March, by the end of March, they had negative $3.4m.

In the table above that was filed as part of the chapter 11 court proceedings, there seems to be an error. Last line should be Net Profit and not Net Loss.

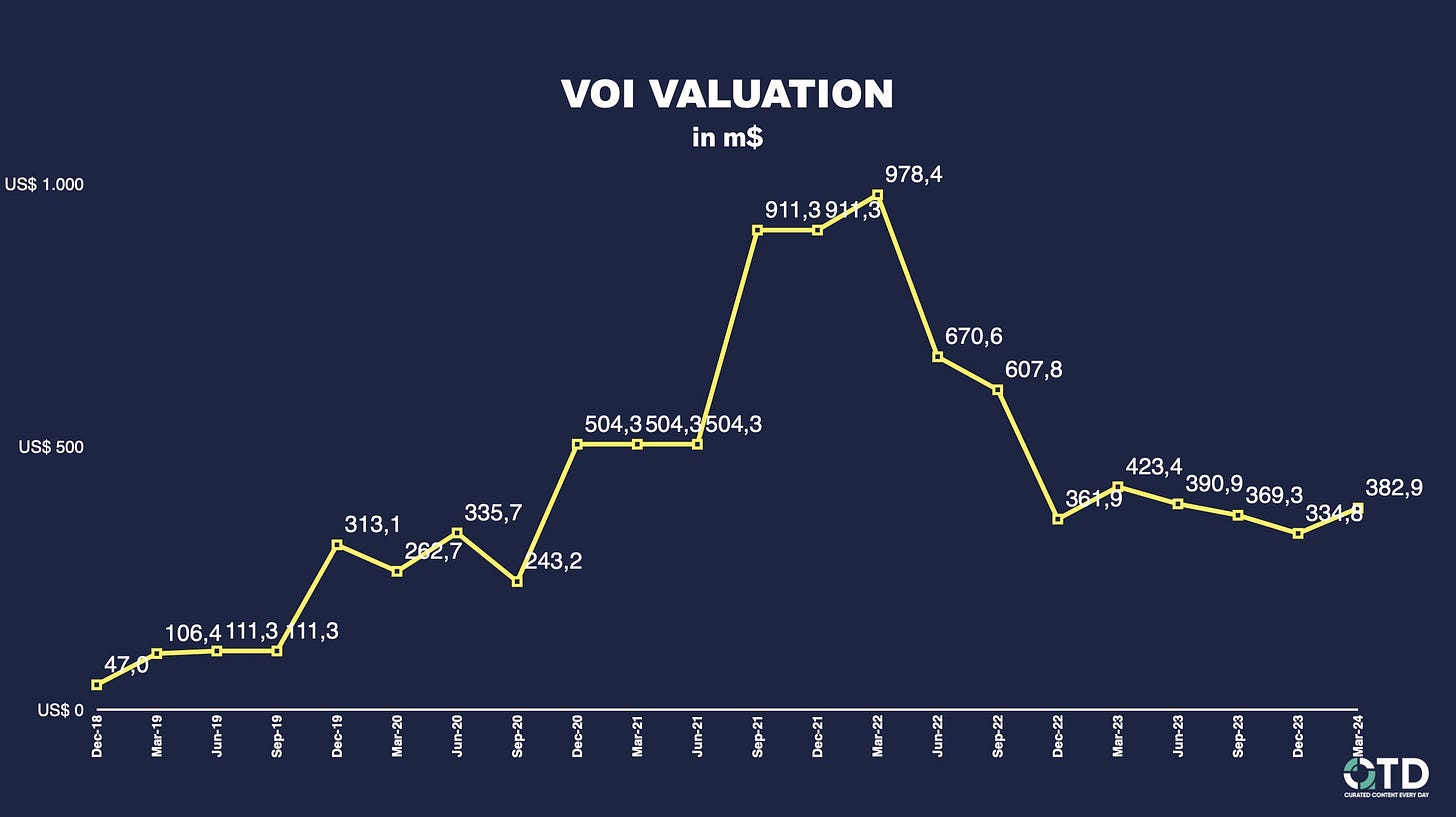

VOI’s Valuation Update - Q1 2024

VNV Global, one of Voi’s largest investors marked down their investment in Voi by ~21%.

With a $5m infusion and converting $18.7m in notes to equity, fair value of their investment went up from $77.3m in Q4 2023 to just $80m Q1 2024.

With the recent $25m raised by Voi, they are valued at $382.9m which is over 3x their revenues and much higher than the rumoured valuation of Tier-Dott both in absolute terms and in revenue multiples. For context, if the rumour is true, Tier-Dott is valued at ~0.6x their expected 2024 revenue.

VNV also reported that Voi did 68 million rides in 2023 and they achieved their first quarter of positive EBIT at group level.

TIER’s 2021 financials and Merger Updates

Tier filed their 2021 annual accounts just recently and here is a snapshot.

In 2021, TIER generated €67.4m in revenue and posted a net loss of €91.5m. Revenue was up 21% in 2021 compared to 2020 where TIER generated €55.7m in revenue.

G&A and Operating expenses were higher than their revenues at €73.7m and €88.6m respectively.

Revenue Split:

Germany: €58.5m

Rest of Europe: €7.3m

Rest of the World: €1.49m

Total accumulated loss at the end of 2021 was €179.4m. They had ~€128m in cash and cash equivalents at the end of 2021.

CEO and Chairman of the Board Lawrence Leuschner received €226k in compensation and CFO and Vice Chairman Alex Gayer received €326k in compensation.

With the acquisition of NextBike in 2022, their revenue was €124.5m in 2022 and they expect low single digit growth in 2023. In 2024, they expect revenues to be under €90m.

For context, Voi’s 2021 revenue was €90.3m and 2022 revenue was €107.9m.

Read the full filing in the Paid section

Merger Updates

In their annual filing, Tier reported on the merger with Dott and mentioned that they have firm commitments of ~€58m from investors. Out of the funds raised, TIER will use €11.8m to repay loans to Goldman Sachs.

On NextBike sale, Tier expects to get “mid double digit million range” in cash. So, around €50m.

If they really do get €50m in cash, that would bring the total new cash to ~€108m with ~€97m available after loan repayment.

Other Updates

In financial year 2021, TIER committed to purchase 75k e-scooters and 101k e-scooter batteries for ~€59m.

In March 2022, Tier acquired Fantasmo Studios for their camera positioning system and in the same year they stopped developing the tech further and wrote down the investment to zero.

This concludes our newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber Section

Thank you for your support so far! If you are on founding member tier, you can reachout to have a quarterly 45min call