European Shared E-scooter Company with 21% EBIT Margin!

Shared e-scooter business with €28m in revenue and 21% EBIT, Upway's 2022 Financials, Beryl Bikes doubled their revenue in 2023 and more..

Welcome to the eighth edition of our OTD Newsletter, and extending a warm welcome to our new subscribers

If you haven’t subscribed yet, please do subscribe!

In this newsletter:

2022 Financials of UPWAY France

Unaudited 2023 Financials of RYDE

Beryl Bikes’ 2023 Financials

Paid Subscriber Section

RYDE’s 2022 Annual accounts PDF

Beryl Bikes’ 2023 Annual accounts PDF

2022 Financials of UPWAY France

In the 16 months leading up to December 2022, e-bike reselling platform Upway France reported €6.5m in revenue and posted a net loss of €5.28m.

By the end of 2022, the company had accrued debts amounting to €12.8m, with €6.68m in cash reserves

In November 2023, Upway raised €27.6m in Series B funding, led by Korelya Capital. They have raised €55.2m so far.

50k shared scooters in Europe and profitable: Financials of RYDE

Norway based e-scooter sharing company RYDE that operates in Norway, Sweden and Finland is our new profitable recent find.

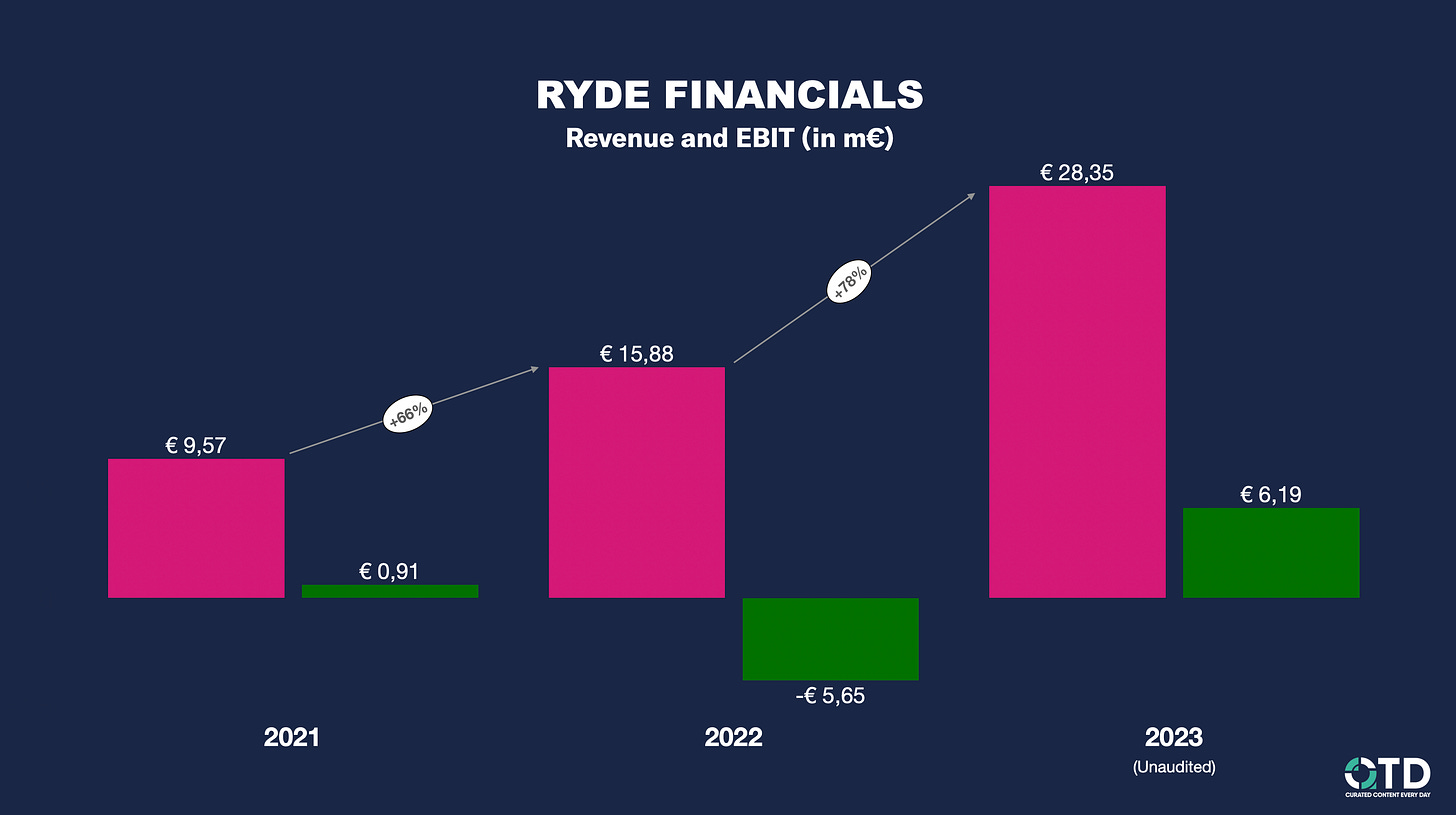

RYDE was founded in 2019 and in 2023, they generated €28.35m in revenue and posted a positive EBIT of €6.19m (21.8%). EBITDA result was €11.62m (40.9%). These are unaudited results and we should see the final audited results sometime this year.

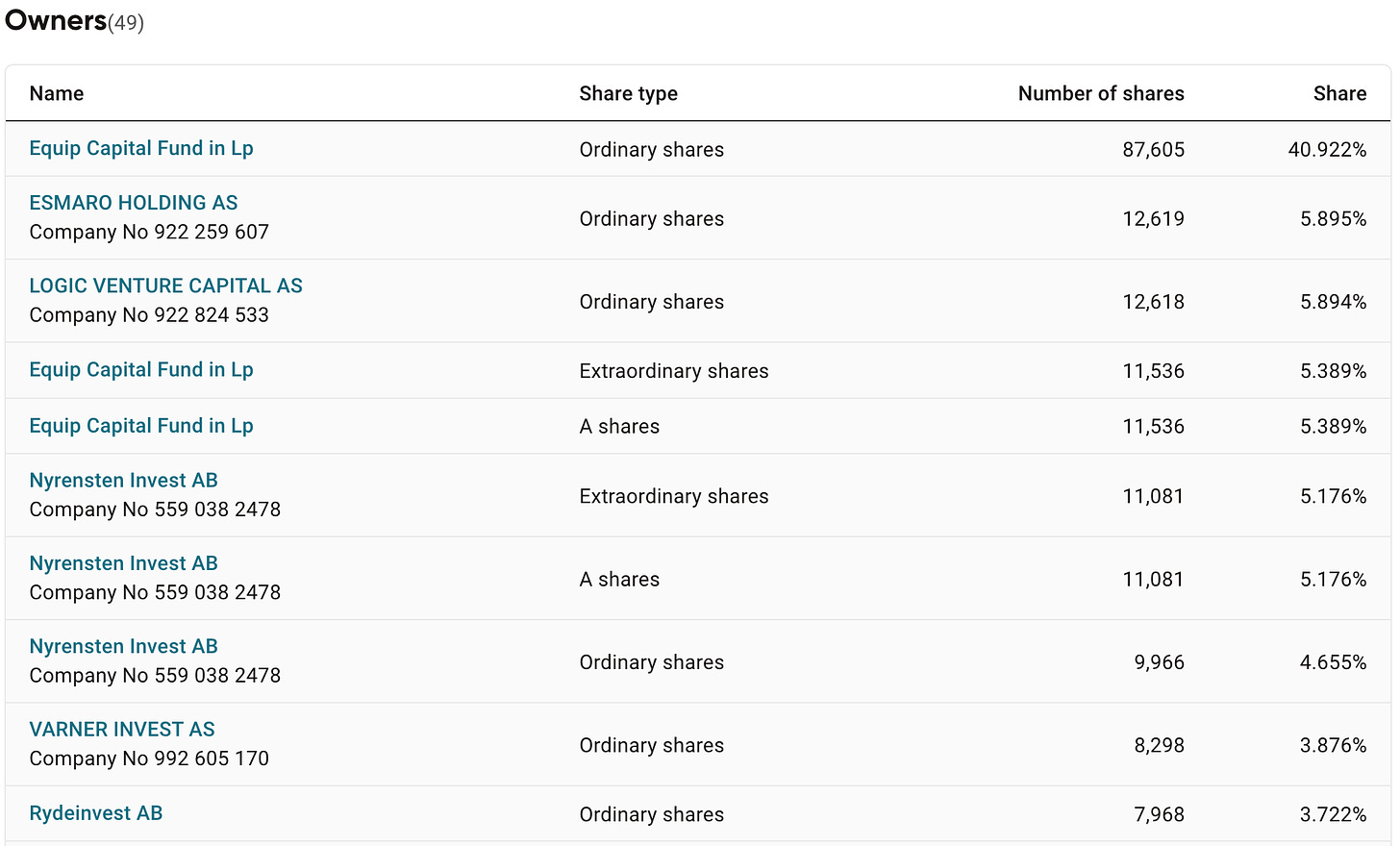

RYDE is operating ~50k e-scooters right now and has grown their revenue by 78.5% in 2023 and 66% in 2022. Interestingly, RYDE is majority owned by a Private Equity firm, Equip Capital AS.

As we don’t have the full 2023 results, let’s take a deeper look at their 2022 numbers.

In 2022, RYDE generated €15.88m in revenues (+66%) and posted an EBIT loss of €5.65m. RYDE posted 17% EBITDA profit in 2022 (€2.79m).

Their operating expenses were €7.18m and they spent €5.91m on salary costs. Interestingly, they booked €8.44m in depreciation costs.

While they had negative EBIT in 2022, they were profitable in 2021 with €910k in EBIT (9.4%) and 45.1% in EBITDA (€4.32m)

What are they doing differently?

Though we think shared e-scooters are a loss making business, what is evident across most companies is that the Gross Margins are decent. Where they fail is G&A and R&D costs, in most cases with large HQ teams and unusually high salaries.

RYDE is the second company that I’ve come across of this size that is profitable, next to SWING (Read full breakdown here).

Looking closely at both these businesses, what is clear is that they operate very lean, especially with a very lean HQ team. In the case of RYDE, they operate as a typical PE owned firm should be run and it is no coincidence that they are majority owned by a PE firm.

As I’ve always said, this business can be profitable if run as a low margin high volume business and not as a VC funded tech business.

We probably will see such profitable companies across different geographies over the next years. In fact, Tier+Dott has the potential to be a similar profitable company if the new management would make a hard reset.

Do you know any other profitable companies? Do send drop a mail to me (prabin@otd.today)

Beryl Bikes’ 2023 Financials

In Financial year ended March 2023, UK based Beryl Bikes more than doubled their revenues to £11.3m (+119%) and posted a loss before tax of £3.8m. Administrative expenses were £7.3m. EBITDA loss was £708.2k

Beryl’s Gross Margin was £4.4m, which is 61% of their revenue.

At the end of March 2023, Beryl had just £345k in cash, though they raised £6.7m in FY 2023. £4.9m in debt was due within 1yr and £10.6m was due after 1yr.

Revenue split by business line

Bikeshare: £11.26m

Consumer Products: £68.7k

Revenue split by Region

UK: £11.28m

Europe: £50.9k

ROW: £730

In 2023, Beryl raised £7m in convertible note from Newstead Capital of which £5.5m was paid in June 2023 and £1.5m in July 2023. These notes bear 8% interest per annum.

Key Performance Indicators

Trips: 1.3m (64% from e-vehicles)

Avg. fleet size: 2181 vehicles (42% e-vehicles)

Avg. trips/bike: 1/day

Avg. trips/ebike: 1.8/day

Avg. trips/escooter: 2.7/day

This concludes our newsletter. If you would like to stay updated everyday, do follow @OTDToday and @prabinjoel on Twitter.

If you would like to receive this newsletter in your inbox, do subscribe and share it with your colleagues!

Paid Subscriber Section

Thank you for your support so far! If you are on founding member tier, you can reachout to have a quarterly 45min call